How to Read an Roi Form for 401k

What is ROI?

Return on investment, or ROI, is a mathematical formula that investors can use to evaluate their investments and judge how well a particular investment has performed compared to others. An ROI calculation is sometimes used with other approaches to develop a business case for a given proposal. The overall ROI for an enterprise is used as a way to class how well a company is managed.

If an enterprise has immediate objectives, including getting market place revenue share, edifice infrastructure or positioning itself for sale, a return on investment might exist measured in terms of meeting one or more of these objectives rather than immediate profit or toll savings.

How do yous calculate ROI?

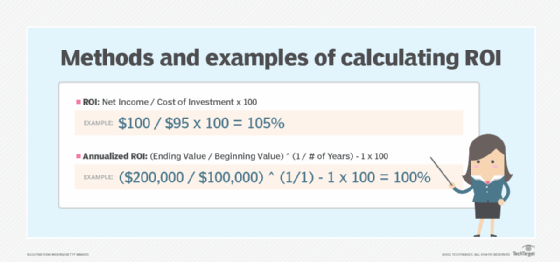

At that place are multiple methods for computing ROI. The nigh common is net income divided by the full cost of the investment, or ROI = Net income / Toll of investment 10 100.

As an example, take a person who invested $90 into a business venture and spent an additional $10 researching the venture. The investor'south total price would be $100. If that venture generated $300 in revenue but had $100 in personnel and regulatory costs, then the net profits would be $200.

Using the formula above, ROI would exist $200 divided by $100 for a caliber, or respond, of 2. Because ROI is virtually ofttimes expressed as a pct, the caliber should exist converted to a percentage by multiplying it by 100. Therefore, this item investment's ROI is 2 multiplied by 100, or 200%.

Compare that to another example: An investor put $10,000 into a venture without incurring whatsoever fees or associated costs. The visitor's net profits were $15,000. The investor made $5,000. It is significantly more than the $200 in cyberspace profits generated in the get-go example. However, the ROI offers a dissimilar view: $fifteen,000 divided past $10,000 equals 1.5. Multiplying that by 100 yields an ROI of 150%.

Although the commencement investment strategy produced fewer dollars, the college ROI indicates a more than productive investment.

Some other possible method to calculate ROI is investment gain divided by investment base, or ROI = Investment gain / Investment base of operations. There are numerous other means to calculate ROI, so when discussing or comparing ROIs between departments or businesses, it is of import to analyze which equation was used to determine the pct. Each equation may measure out a specific set of investments. ROI is shown as a per centum instead of a ratio for ease of agreement.

How do y'all translate ROI calculations?

ROI tin can be used to gauge different metrics, all of which help determine how assisting a business is. To summate ROI with the almost accuracy, total returns and total costs should be measured.

When ROI calculations have a positive render percentage, this means the business concern -- or the ROI metric being measured -- is profitable. Meanwhile, if the calculation has a negative ROI percentage, that means the business -- or the metric it is existence measured against -- owes more money than what is existence earned. In brusque, if the percentage is positive, the returns exceed the total toll. If the pct is negative, the investment is generating a loss.

What is ROI used for?

ROI can be used to evaluate various investment decisions, comparison them to their initial cost. Businesses also use ROI calculations when evaluating future or prior investments.

Individuals tin calculate the ROI to judge their ain personal investments and compare one investment -- whether information technology is a stock holding or a financial stake in a pocket-sized company -- against another in their own investment portfolios.

What are examples of ROI calculations?

Calculating the investment figures for each piece of the ROI equation can sometimes get complicated for businesses.

For example, if a company wants to invest in deploying new computers, information technology must consider a variety of deployment costs. The business organization needs to consider the actual price of the computers, revenue enhancement and shipping costs, consulting fees or support costs paid to purchase, plus setup and maintenance costs.

Then, the business would need to calculate net profit over a set period of time. These net profits could include hard dollar amounts coming from increased productivity and a reduction in maintenance costs compared to the previous computers.

That business could then calculate the ROI when evaluating ii different types of computers using anticipated costs and projected gains to decide which ROI is college. Therefore, which figurer represents the better investment: Investment A or Investment B?

The business could also summate the ROI at the cease of the set fourth dimension catamenia using actual figures for the total net income and total cost of investment. Actual ROI can then be compared to the projected ROI to aid evaluate whether the computer implementation met expectations.

What are the benefits of ROI?

Benefits of ROI ratios include the following:

- By and large piece of cake to calculate. Few figures are needed to complete the adding, all of which should exist available in fiscal statements or residue sheets.

- Comparative analysis capability. Because of its widespread use and its ease of adding, more than comparisons can be fabricated for investment returns between organizations.

- Measurement of profitability. ROI relates to net income for investments made in a specific business unit. This provides a better mensurate of profitability by company or team.

What are the limitations of ROI?

ROI is one of the most common investment and profitability ratios used today. However, it does accept some drawbacks. These include the following:

- Inability to consider fourth dimension in the equation. On the surface, the higher ROI seems like the better investment. But an investment that takes ten years to produce a higher ROI pales in comparison to a 2nd investment that takes just one year to produce a slightly lower ROI.

- ROI calculations can differ between businesses. Because at that place are unlike equations to calculate ROI, non every business uses the same one, making the comparison between investments irrelevant.

- Managers might only select investments with larger ROIs. Some investments with lower ROIs may still increase the value of a business. Merely suboptimal choices could lead to poor allocation of resources.

- No mode to account for nonfinancial benefits. Using the ROI for new computers as an example, a business can use specific dollar amounts to calculate the net turn a profit and full costs to come up upward with ROI. Still, computing the value of improved worker morale as a issue of getting new computers is hard. Businesses tin, notwithstanding, calculate ROIs for such nontangible benefits by labeling these calculations as soft ROIs, while the calculations fabricated with tangible dollar amounts are chosen difficult ROIs.

What are the alternatives to ROI?

In that location are similar alternative measurements to ROI that businesses use to varying degrees. These include the following:

- Annualized ROI. This class of ROI considers the length of time a stakeholder has the investment. Here is an example of an annualized render calculation: Annualized ROI = (( Final value of investment - Initial value of investment) / Initial value of investment ) x 100. Also, the annual performance rate can exist calculated using ((P + G) / P) ^ (one / n) - 1, where P equals initial investment, G equals gains or losses, and due north equals the number of years the investment is held.

- Social ROI (SROI). SROI is result-based and considers the broader impact of economic, environmental and social value. It translates these outcomes into tangible dollar values. The calculation is SROI = Net nowadays value of benefits / Internet present value of investment.

- Marketing statistics ROI. This helps make up one's mind the effectiveness of a marketing campaign strategy or marketing program. A basic calculation is (Sales growth - Marketing toll) / Marketing price.

- Social media statistics ROI. This helps decide the effectiveness of a social media campaign and can include how many views or likes are generated. A simple calculation to measure the time, money and resources that went into social media ROI by revenue is (Value / Total investment) x 100.

Learn how we can judge 5G'southward near-term bear upon and ROI and how it affects the economy.

This was last updated in August 2021

Continue Reading About ROI (render on investment)

- iii COVID-xix wellness organization investments for better ROI, patient UX

- How AIOps investment improves customer service, boosts ROI

- Call center client feel ROI is more nearly metrics

- four Steps to Increasing Upshot ROI with Intent Information

- Flexible CIOs gain friends in finance

Dig Deeper on CIO strategy

-

How to measure out and improve digital transformation ROI

-

turn a profit margin

-

return on equity (ROE)

-

gross domestic product (GDP)

harrelltrailtandes.blogspot.com

Source: https://www.techtarget.com/searchcio/definition/ROI

0 Response to "How to Read an Roi Form for 401k"

Postar um comentário